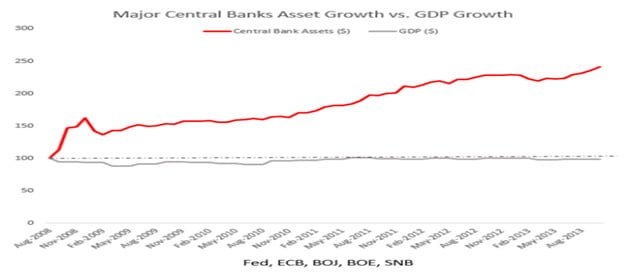

The following chart illustrates the greatest ping-pong rally in human history, where all major central banks are printing against one another and expanding their balance sheets (red line). Overall, no country is getting ahead economically, which can be seen in the gray line representing the combined GDP (Gross Domestic Product). This hasn’t changed much since this chart was created, except the red line (currency aggregates) keeps heading higher.

The Bank of Japan and the European Central Bank are currently creating the most inflation via currency aggregates (the red line). The gamble that the central banks have made, in my opinion, is that they think they can keep their various currencies trading against one another within some kind of fair zone for world-wide equilibrium. To do so, they certainly couldn’t have their respective currencies crashing against real money, so suppressing gold has been a mandatory component to their strategy.

I call this the London Gold Pool Part II Redux. (I’d suggest those not familiar with the first London Gold Pool in the 60s to read up about it on Wikipedia).

By following this circular reasoning, I believe, the central bank’s hope was that they could eventually coordinate a smooth landing as the stimulus (or cocaine) was eventually weaned. Therefore, fiat currencies would find stable ground thereafter as economies recovered. This, as all Ivory Tower theories go, was a great plan in the boardroom but this is impossible in real world applications. There is simply no such thing as coming off of enormous doses of cocaine without consequences. Either one has to keep injecting the stimulus to stay high or the come down will be painful.

There are currently no good choices for the world’s central banks; they’ve boxed themselves in. I believe inflation via continued central bank asset purchases (the red line) will continue to rise faster than any time in history because coming off the cocaine would be unacceptable to over-indebted governments. Simply, when governments are over-indebted, they cannot afford any prolonged deflation, which is the case today.

FMT Advisory believes that if one wanted to hedge their holdings in gold against central banker madness one just needs to sell the yen. Short yen/long gold has been a winning combination since 2012 when Japan went full retard on deflation, and I believe it will continue to be. To apply such a strategy, please don’t hesitate to contact me.

Best regards,

Nicholas Green

CEO and Chief Portfolio Strategist

888-649-6556

www.fmtadvisory.com